[ad_1]

What does car insurance cover? Understanding the difference between collision vs. comprehensive car insurance is crucial for protecting your vehicle.

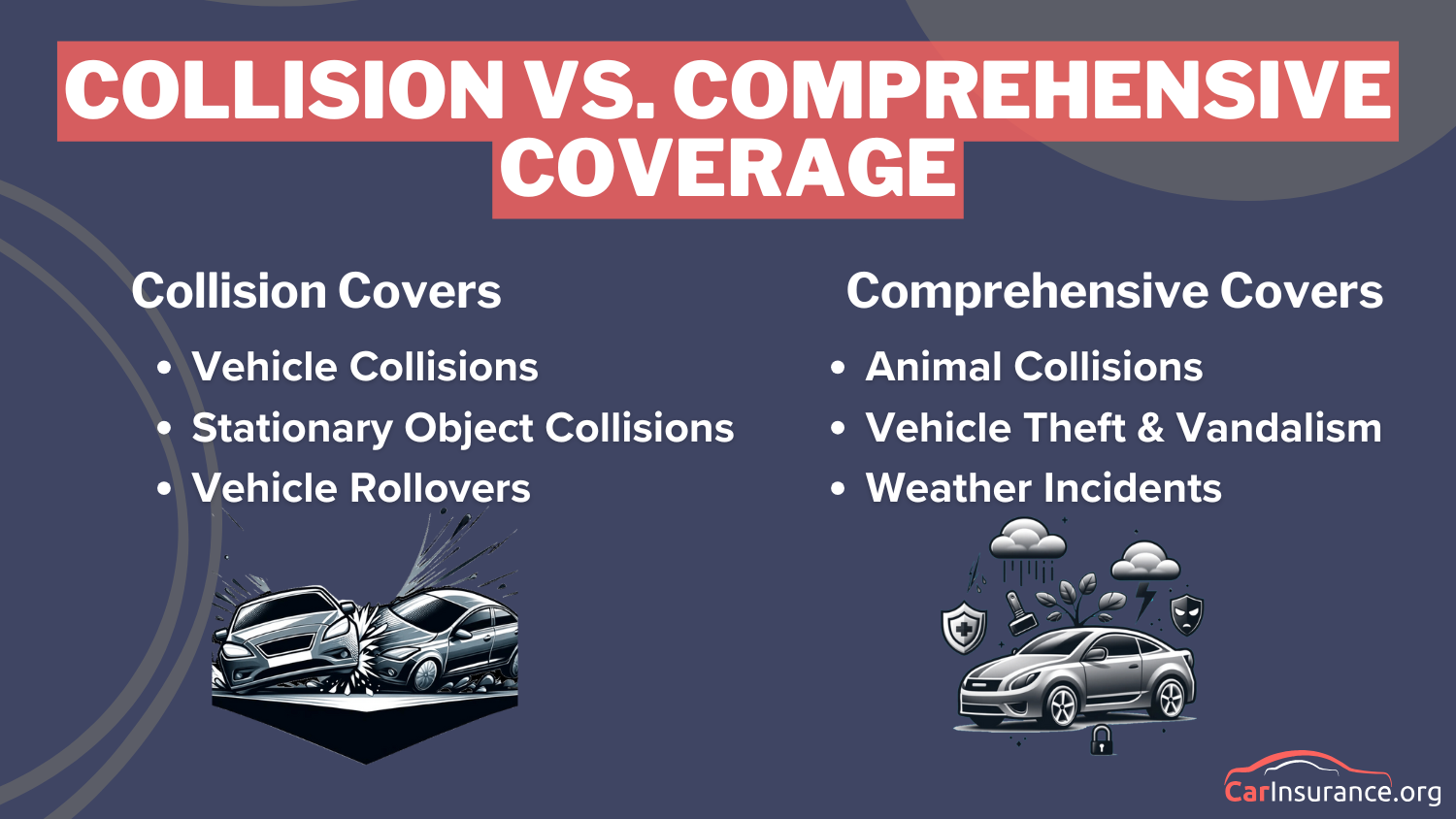

Collision car insurance covers accidents with other vehicles or property, while comprehensive coverage applies to non-collision events, such as theft, fallen trees, or hitting an animal.

This article breaks down the key differences between collision and comprehensive insurance, helping you understand which protection best fits your needs.

We explore coverage costs across major insurers, with USAA leading the market at $55 monthly for collision and $15 a month for comprehensive insurance. Discover essential coverage features, available discounts, expert tips, and cheap car insurance quotes by entering your ZIP code.

Just The Basics

- Collision insurance covers accidents with other vehicles or property

- Comprehensive coverage protects against theft and natural disasters

- Both comprehensive and collision coverage are required for financed vehicles

Collision vs. Comprehensive Car Insurance Explained

Do I need comprehensive and collision insurance? Knowing what each of these policies covers can help you determine how much insurance you need for a car. Collision insurance provides damage coverage related to accidents, regardless of fault, and comprehensive coverage safeguards against non-collision incidents such as theft, vandalism, fire, or weather.

Is comprehensive insurance full coverage? The answer depends on how you define “full coverage.” Generally, full coverage includes both comprehensive and collision policies, as well as minimum liability.

Collision vs. comprehensive auto insurance is important for those who need to cover a greater variety of accidents, especially in areas at risk for weather-related events such as hurricanes and wildfires. These two coverages work together to provide complete protection.

Learn More: Where can I get cheap full coverage car insurance?

What Comprehensive vs. Collision Car Insurance Covers

The table highlights how car insurance works and the key differences between collision and comprehensive coverage. Collision insurance covers accident-related damage, while comprehensive coverage pays for non-collision incidents.

Collision vs. Comprehensive Car Insurance Coverage Comparison

Choosing between collision and comprehensive coverage depends on your priorities. Collision insurance offers protection for accidents, but comprehensive coverage covers a broader range of non-collision incidents if you live in a high-risk weather area.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comprehensive vs. Collision Deductible & Car Insurance Costs

Collision and comprehensive coverage costs can vary widely, but collision coverage always costs more than comprehensive insurance. USAA and Geico have the cheapest monthly rates for both types of policies.

Collision vs. Comprehensive Car Insurance Monthly Rates by Provider & Coverage

If you decide to buy full coverage, which combines comprehensive and collision car insurance with your state’s minimum liability, rates are higher. However, full coverage is still cheaper than buying each type of insurance separately.

Your insurance deductible will also impact rates. The comprehensive and collision coverage deductible is the amount you pay out-of-pocket before insurance kicks in, and your rates will be higher if you choose a lower deductible. If you use your car insurance deductible for a claim, expect your collision vs. comprehensive car insurance quotes to be higher.

Compare costs from multiple companies, as each has different coverage limits and exclusions, to get better rates. For instance, the Progressive collision coverage limit helps ensure that you’re covered in case of an accident, but choosing higher limits will lead to higher premiums.

Top Insurance Discounts for Collision & Comprehensive Insurance

Stop overpaying for comprehensive and collision insurance by comparing quotes and discounts from multiple providers. This table showcases the various discounts offered by top insurance companies for both collision and comprehensive coverage, highlighting the benefits of being a claim-free and low-mileage driver.

Collision vs. Comprehensive Car Insurance Discounts by Provider

If you drive less than 12,000 miles annually, you’ll get the biggest discounts from collisions vs. comprehensive car insurance companies like Allstate, Progressive, and State Farm. USAA, Geico, and Liberty Mutual have cheaper car insurance for multiple vehicles by offering savings for families with more than one car.

Read More: How to Lower Your Car Insurance Costs

Choosing Between Collision vs. Comprehensive Insurance

The main difference between collision vs. comprehensive car insurance is what each policy covers. Buying car insurance involves understanding that collision is more expensive, starting at $55 per month, and paying for damages from collisions with other vehicles or stationary objects. Comprehensive coverage applies to claims for weather damage, vandalism, theft, and more not related to a collision.

Auto loans and leased vehicles often require full coverage insurance, which includes comprehensive and collision.

Dani Best

Licensed Insurance Producer

USAA is the most affordable collision vs. comprehensive car insurance company for military members, while Geico has the lowest rates in most states, starting at $15 per month.

Regardless of the provider you select, taking advantage of discounts like anti-theft devices, safe driving programs, and multi-car policies can help reduce your insurance costs while maintaining the protection you need for both collision-related and non-collision incidents. See if you’re getting the best deal on car insurance by entering your ZIP code.

Frequently Asked Questions

What is collision insurance?

Collision auto insurance applies whenever you file a claim for an accident with another vehicle or stationary object. It pays for repairs on your vehicle, and the insurance covers a rental car or public transportation during repairs if you have reimbursement coverage.

Is collision better than comprehensive?

Neither is “better.” Both types protect your vehicle in different situations. While collision covers accident damage, comprehensive protects against theft, weather, and other non-collision incidents.

Do you need comprehensive and collision car insurance?

That depends on your car’s age, value, and the risk of non-collision events like theft or vandalism in your area. In general, you should have collision and comprehensive insurance if you have a newer car or cannot afford to pay for repairs out-of-pocket.

When to drop collision insurance?

Consider dropping collision coverage when your car’s value is less than 10 times your premium. If you want to save money on car insurance without dropping coverage, enter your ZIP code to see how much you could save.

Should you have collision insurance on a 10-year-old car?

Is a parked car hit comprehensive or a collision claim?

If your parked car is hit by another vehicle, it’s covered under collision insurance, not comprehensive.

Is hitting a person a collision or a comprehensive claim?

This falls under collision coverage since it involves an accident with your vehicle, but your liability insurance would primarily cover injuries to the person.

What happens if you scratch someone’s car and leave it?

Do I need collision insurance if my car is paid off?

How much should I put for comprehensive coverage?

Choose a deductible that you can comfortably afford in an emergency. Most drivers opt for $500 to $1,000.

What does comprehensive insurance not cover?

Comprehensive doesn’t cover accident-related damage, mechanical failures, routine maintenance, or normal wear and tear.

What are the risks of comprehensive insurance?

The main risk is having a deductible that’s too high for your financial situation or inadequate coverage limits for expensive vehicles.

How do I avoid paying my collision deductible?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a…

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

[ad_2]

Source link