[ad_1]

UK risk managers identified five key themes that could affect their businesses, topped by “technology, AI and cyber,” according to AIRMIC, the British risk management group, which conducted a survey of its members.

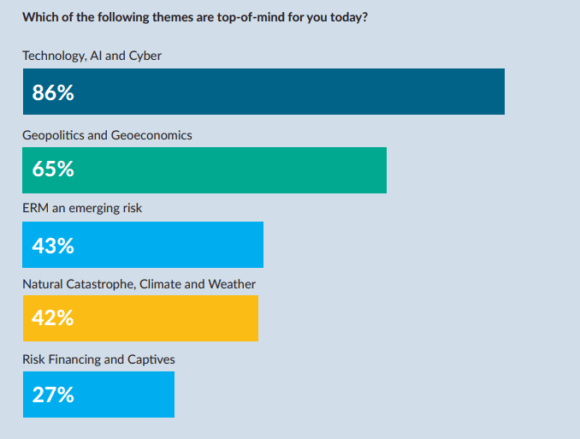

Nearly 90% of respondents pointed to tech, AI and cyber as their principal risk concern, with “geopolitics and geoeconomics” following at second place, identified by 65% of respondents, said AIRMIC’s survey report which was released at the group’s annual conference in Liverpool, England this week. (See chart below).

Interestingly, the three principal themes of year’s AIRMIC conference – geopolitics, technology and climate – were the same as last year’s meeting.

“Some respondents felt that that their organization’s use of technology had been evolving more quickly than for the insurance and risk industry, with the outcome that the available solutions are lagging behind business needs.”

The AIRMIC survey report said that recent cyber-attacks on retailers in the UK (Marks & Spencer, the Co-Op Group and Harrods) have shown how important it is to have “dynamic risk management which defends the organization from the risk, rather than place an emphasis on the after-effects and response.”

Growing cyber threats from criminals and state actors come “against a backdrop of organizations struggling with increasing costs due to disruptions to complex global supply chains, geopolitics, regulation and volatility,” said the report titled “Another World Is Possible.”

While artificial intelligence (AI) provides an opportunity to reduce costs, the report warned, it also creates risks that need to be managed.

Survey respondents with businesses that depend largely on technology are concerned that “their organization’s use of technology has been evolving more rapidly than what the insurance and risk industry is currently equipped to deal with,” said the report, noting that this fact is leading them to seek new alternative risk transfer mechanisms.

Moving on to “geopolitics and geoeconomics,” AIRMIC said: “Geopolitical risk has the ability to force wholesale changes to global businesses,” leading them to pursue different strategies. “Geopolitics also brings a direct impact on the economy, which could lead to increasing costs for businesses and less disposable income for consumers.”

Emerging Risks

“Enterprise risk management and emerging risk” was ranked at number 3 by 43% of respondents, followed by “natural catastrophe, climate and weather,” listed by 42% of respondents as number 4 on the list of concerns. And finally, “risk financing and captives” was ranked at number 5 by 27% of respondents.

Discussing the theme of emerging risk, AIRMIC explained that the phrase can refer to risks that are not fully understood or risks that were thought to be understood, but have been pushed to new extremes “or into new contexts, where the limits of past understanding are exceeded.”

For example, UK energy costs previously were “barely noticed” but are now a major factor when managing a business, AIRMIC said, citing comments from Make UK, the manufacturers’ trade body, which warns that the UK needs to cut its industrial energy bill if the government’s aspirations for growth in the sector are to succeed. (On June 2, Make UK said in a report that the country’s industrial energy costs are four times higher than the US and 46% above global average.)

Moving on to number 4 on the list of risk themes – natural catastrophe, climate and weather – AIRMIC said global leadership on climate action is in “danger of faltering as world leaders are shunning the annual COP summits.”

“For our survey respondents, climate change could have pervasive impact to global operations, but they can be mitigated if acted on early,” the report said. “Yet other respondents said natural catastrophe risks are the key element behind why they are looking at the risk financing and captive options for their upcoming insurance renewals.”

Similar to the trends identified in the AIRMIC survey, digitalization/cyber incidents, climate change/natural catastrophes and an uncertain geopolitical environment also dominated the Allianz Risk Barometer’s top business risks for 2024.

Risk Financing and Captives

And last but not least – at number 5 on AIRMIC’s list of risk themes – is “risk financing and captives.”

“Some respondents felt that that their organization’s use of technology had been evolving more quickly than for the insurance and risk industry, with the outcome that the available solutions are lagging behind business needs,” the report cautioned.

As a result, risk managers are concerned whether insurance is the best risk management tool for their organizations, the report indicated.

“For others, such concerns surface after they have refreshed their enterprise risk management frameworks, which has led them on a process of rethinking how they absorb the materialization of risks, and whether their current insurance portfolio is still the best fit for their needs,” the AIRMIC report said.

“The development of cyber insurance products and responses for them is critical, as is the development of understanding regarding the opportunities and risks associated with AI.”

Captive Insurers

Captives are also integral to strategy — by providing agile and resilient risk financing strategies, regardless of the insurance market cycles, the report indicated. (The UK government is expected to soon announce a regulatory framework for onshore captive insurance companies, which was the subject of much discussion and anticipation at the AIRMIC conference).

“The use of captives for the incubation of emerging risks, blended catastrophe covers and sustainability projects is directly aligning the use of captives to the strategies of organizations in an increasingly connected, complex and fast-moving world,” it added.

“Taking risk is about balancing the upside and downside of risk in the context of risk appetite – how much risk the organization wants to take. In intensely uncertain times risk appetite in the short and long term, by jurisdiction, by risk and even by product line, should be expected to change,” said Julia Graham, CEO of AIRMIC, who was quoted in the report. “The words to use are ‘realistic risk appetite.’ In challenging times, this is when the experienced risk professional can demonstrate their value at a strategic level.”

During a press conference to discuss this report and other reports released at the conference, Hoe-Yeong Loke, AIRMIC’s head of Research, who wrote the survey report, noted that there are also upside risks and opportunities associated with today’s risk landscape.

For example, he said, the widespread use of AI is clearly good news for productivity but also is “a double-edged sword if one thinks of online safety and ethical risks that come with the use of AI.”

As the report said: “There can be gains to be had even during periods of volatility if organizations are nimble and aware of their environment, and that is how they can build resilience and run a sustainable business.”

Here are the upside risks and opportunities cited in the report:

- Widespread use of AI

- Digitalization

- Regulatory change

- Financing opportunities

- Agility in innovation

- Clean energy

- Transition to net zero

- Global connectivity

- Parametric insurance

- Robotics

- Captives

- Increased productivity

- Opportunities to do things differently

Survey methodology

The report was based on 92 responses gathered in an AIRMIC survey conducted from May to June 2025.

Topics

Trends

Cyber

InsurTech

Data Driven

Artificial Intelligence

Tech

[ad_2]

Source link